Cheese, specialty food’s top category with brick-and-mortar retail sales of $4.3 billion in 2019, is experiencing mixed results amid the coronavirus pandemic, in part enjoying a boost as more people eat at home but also suffering the result of foodservice closures. Products for snacking, flavor innovations, and dairy alternatives are poised to continue to drive consumer interest.

As people consumed more meals and snacks at home since March 2020, cheese fell into a group of essential categories that also included meat, bread, and many center-store pantry items. From January to April 2020 during the first wave of COVID-19, specialty and non-specialty cheeses grew 20.3 percent, versus 17.5 percent the prior year.

Sales could shift, however, as the pandemic and related economic uncertainties and unemployment linger. According to Mintel’s Cheese, November 2020 report, through December 2021, people will settle into routines and remain cautious amid the COVID-triggered recession, meaning sales of the total cheese category (specialty and non-specialty) could decline from their peak. From 2022-2025 as a return to normalcy benefits foodservice and reduces at-home eating, retail sales will likely fall back to their pre-COVID trajectory, says Mintel.

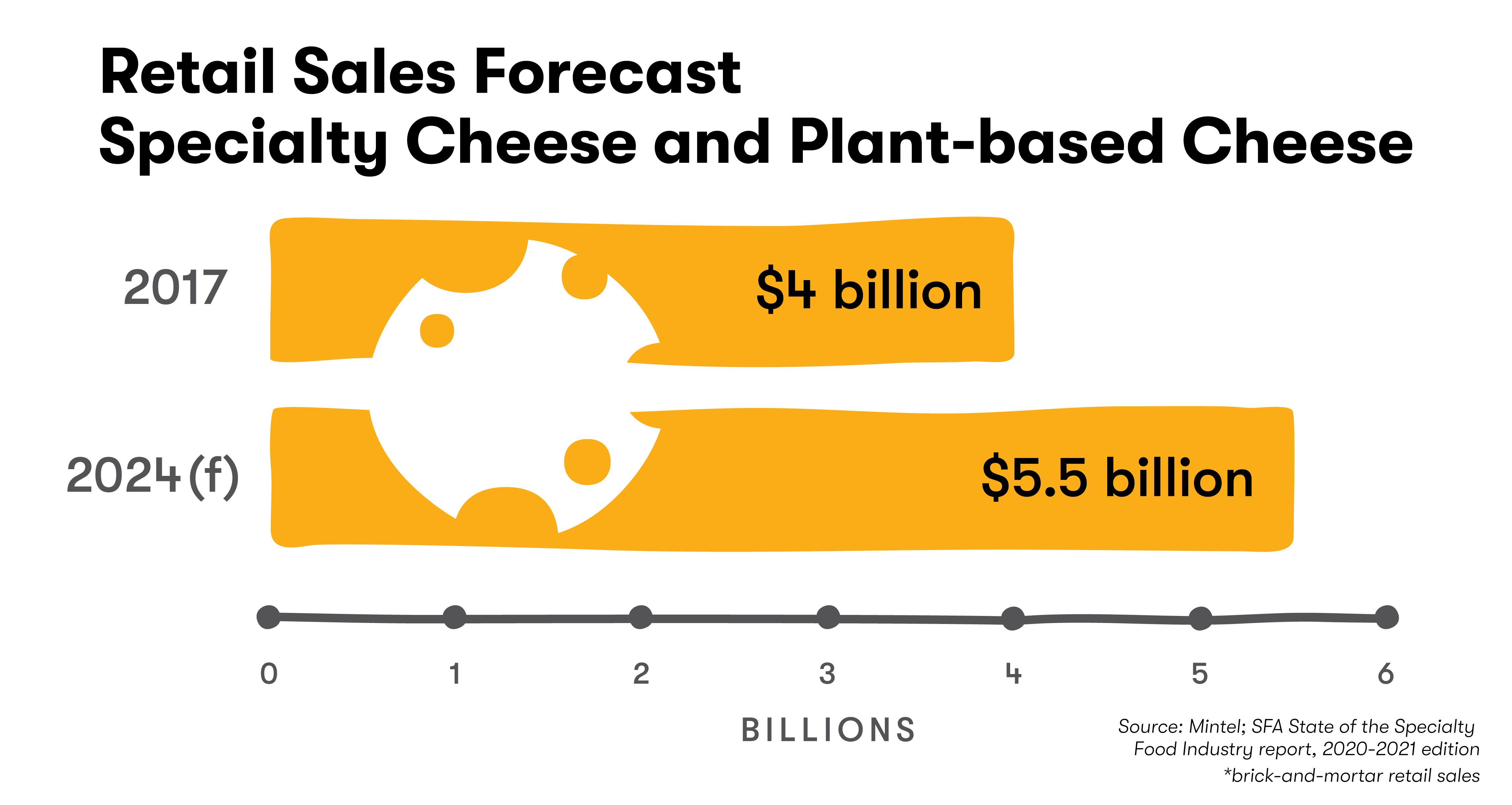

Specialty cheeses specifically, are forecast to continue modest growth at retail. According to the Specialty Food Association’s State of the Specialty Food Industry research, 2020-2021 Edition, produced with Mintel, specialty cheese grew 3.4 percent between 2015 and 2019 and will grow another 3.4 percent by 2024 when sales are expected to hit $5.5 billion.

Source: Mintel; SFA State of the Specialty Food Industry report, 2020-2021 Edition

Source: Mintel; SFA State of the Specialty Food Industry report, 2020-2021 Edition

*Brick-and-mortar retail sales

Foodservice Struggles

Foodservice sales have been disrupted as restaurants were forced to close in-person dining and rely on off-premises sales. Some foodservice establishments got creative, turning into corner-store grocery formats to sell their inventories. For example, Sweetgreen, a fast-casual chain, launched The Tavern to sell cheeses, meats, and other products. On the supply side, cheesemakers and local dairies have responded by increasing their e-commerce business to sell direct to consumers. Some retailers, makers, and foodservice operators partnered to form Victory Cheese, a grassroots movement started in the spring to help preserve American cheesemakers by offering assortments from small- and medium-sized producers, hard hit by restaurant closures.

Trends

As COVID-19 persists and consumers continue to stick close to home, several on-trend product innovations have specialty cheese poised to respond to consumers’ desires for snacking and meal solutions, flavor adventure, and non-dairy alternatives.

Snacking. According to Mintel’s Cheese, November 2020 report, snacking more frequently is the top reason consumers give for eating more cheese than a year ago, followed closely by using cheese more in meals. More products are hitting the market that address snacking occasions. At the SFA’s Specialty Food Live! event earlier this month, Cello showcased a new snack pack with Copper Kettle cheese paired with dried lemon, ginger, cherries, and praline pecans among other varieties. Champignon North America offered new Briettes in flavors like Creamy and Buttery Red in 4.4-ounce sizes, and Tapitas Chorizo & Manchango Cheese from Noel Alimenatia combined traditional Spanish products in a mini 1.75-ounce tapas set.

Flavored cheeses. According to Mintel data, 40 percent of cheese consumers would be motivated to try a new cheese if it featured unique flavors, but they want to explore without straying too far from the familiar. Pairing traditional favorites like Cheddar or mozzarella with flavor profiles like fruits, chilis, vegetables, or spices can add adventure without taking consumers out of their comfort zone. Among new products being introduced at Specialty Food Live! were Laura Chenel’s new line of 4-ounce goat cheese logs in flavors like Fig & Grapefruit and Kalamata Olive, and Wood River Creamery’s Cheddar Grueyere in Fenugreek flavor.

Plant-based. Dairy-alternative cheeses comprise about 3 percent of the mature specialty cheese category and these innovations are helping boost sales. Among new introductions, Wensleydale has introduced Sheese, a dairy-free cheese substitute that is made with coconut oil in varieties like Cranberry and Greek Style. And Cheddar Craving Vegan Cheese from Seed Ranch Flavor Co. is a plant-based cheese powder that can be used in recipes to add flavor.

At-home meal prep. Consumers are seeking products to make cooking easy and interesting. More sliced cheeses, good for sandwiches, burgers, and grilled cheese, are hitting the market, including sliced Havarti from Buholzer Brothers and sliced Raclette, in flavors like smoked and truffle, from Mifroma. A 2021 subtrend of at-home cooking identified by the SFA’s Trendspotter Panel is restaurant cooking in the home kitchen, where people seek to replicate at-home the experiences they used to enjoy while dining out. New cheeses to market like Ambrosi Cheese USA’s Fiore Sardo, a complex hard Sardinian sheep’s milk cheese that can be grated on pasta or enjoyed alone, and Montasio, a semi-hard cow’s milk cheese that is been a rarity to find in the U.S., are offering restaurant-level experiences.

Related: Retailers Get Behind Victory Cheese Initiative; Cheese Focus: Pivots With Staying Power.