Snarls in the specialty food supply chain are reverberating throughout the industry, causing delays and impacting costs, but how long will they last, and what can specialty food makers do about them?

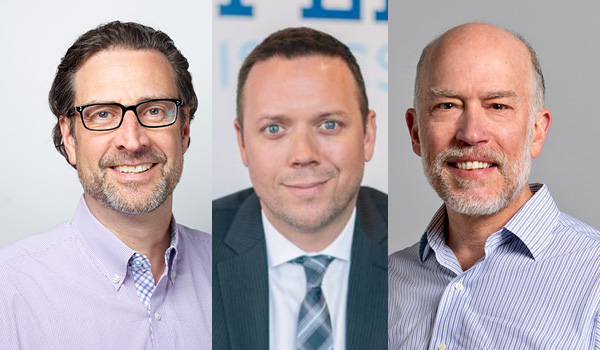

Bob Burke, principal, Natural Products Consulting, Jeff Grogg, founder and managing director, JPG Resources, and Andrew Lynch, president and co-founder of Zipline Logistics, will lead a discussion on that topic beginning at 11:30 a.m. on Monday, Feb. 7, at this year’s Winter Fancy Food Show in Las Vegas.

This Maker Pass session is open to Fancy Food Show attendees holding a Maker Pass, a one-price ticket of $99 for SFA members, $199 for non-members, that entitles pass holders to all six Maker Pass sessions. Information about obtaining a Maker Pass can be found here.

“We're going to be discussing the whole wide spectrum of supply chain issues,” said Burke. “That includes everything from sourcing and manufacturing to transportation, and then some of the ancillary things like watching your margins, what you can do to improve them, stabilize them or minimize erosion, what you might be able to do on the pricing side.”

Pricing has been a significant challenge for specialty food makers, he pointed out, citing increased cost pressures for labor, ingredients, shipping and other areas. Many suppliers have reluctantly had to increase prices to cover their own cost increases.

Transportation problems have been pervasive during the pandemic. In some cases, distributors may be delayed in picking up product, for example, which could result in out-of-stocks at the retail level.

“It could be problems with trucking capacity, which is being sucked up by Amazon and other ecommerce players, plus driver shortages, people out sick — all of that is rippling through the system,” said Burke. “It is really causing a lot of headaches for suppliers.”

And for many suppliers that depend on importing product from overseas, cost increases have been astronomical.

The session will look at how makers can take steps to address these challenges, the financial impact on sales and margins, and the outlook for the specialty food supply chain in the year ahead.

“I think we're going to be in this at least for the next six months, and I am hoping we're out of it as we go into the fall,” said Burke. “That might be wishful thinking, but that's what I'm hoping.”

In the meantime, he, Grogg, and Lynch will talk about the challenges that specialty food makers are having in the current environment, and how they might seek to overcome them. For example, makers who are using a co-manufacturer might want to try to request longer production runs to prevent running short of supply, or scaling back their product lines, or perhaps buying some commodities further out than they have in the past. Burke and Grogg will discuss the potential benefits and drawbacks of solutions such as these, and others.

Related: Biden to Address Supply Chain Woes; Maintaining Supply Chain Success in the New Normal.